Special report on estate planning for farmers: Part 2 of 7

Posted on 05/06/2011 at 11:42 AM by David Repp

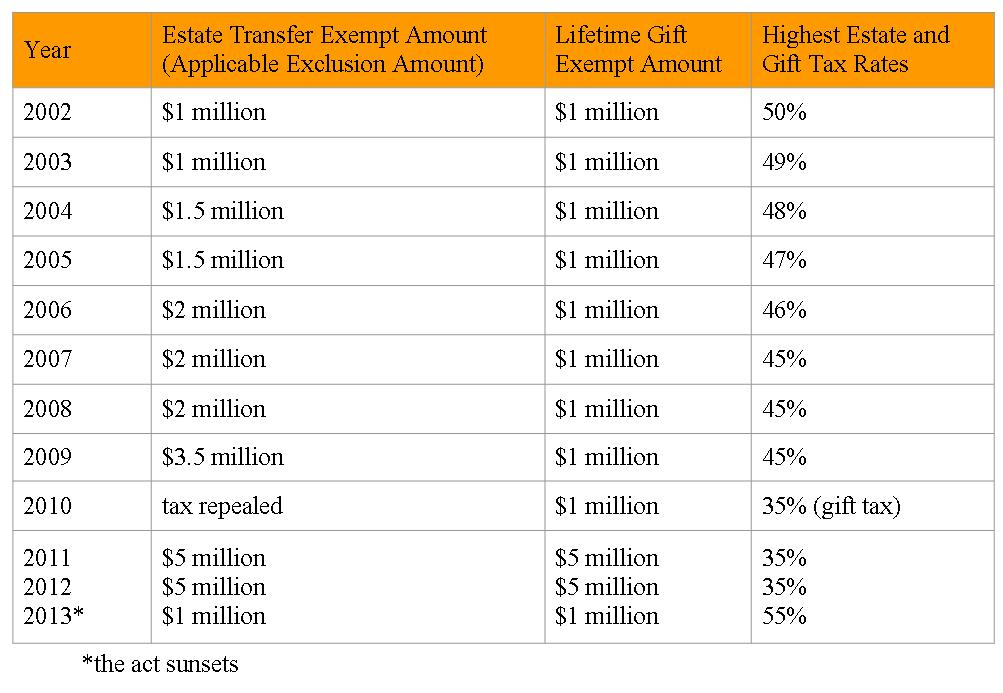

In a special report prepared in conjunction with a presentation at the University of Iowa College of Law's 2011 Spring Tax Institute, David Repp takes in in-depth look at estate planning considerations for farmers and other landowners. Part 2 of 7, below, focuses on the past, present and future of the estate tax. Estate Tax: Where It's Been, Where It Is, and Where It's Going Timing is everything. Congress and the President hailed the beginning of the end of the estate tax in the Economic Growth and Tax Relief Reconciliation Act of 2001 ("EGTRRA"), as amended by Tax Relief, Unemployment Insurance Reauthorization and Job Creation Act of 2010 ('TRUIRJCA'). Under EGTRRA and TRUIRJCA, the amount of assets that a person can convey to another at death without tax, herein called the "unified credit amount," is currently $5,000,000 ($10,000,000 for married individuals). See chart above.

In 2013, the party is over and the hangover begins. The estate tax is fully resurrected as if EGTRRA had never existed. The unified credit amount snaps back to $1,000,000 (where it was scheduled to be prior to EGTRRA) and the highest marginal estate tax rate (currently 35%) jumps to 55 percent. This presents a rather uncomfortable situation for, say, an ailing mother who may know that if she dies on December 31, 2012, she may leave an entire estate to her heirs tax free, but if she survives to January 1, 2013, half of her estate is taxed away. Unless, of course, Congress and the President, once again, change the law. EGTRRA also added a few surprises affecting gifts. Under pre EGTRRA law, an individual could use up part or all of his or her unified credit amount during life in the form of gifts free of gift and estate taxes. That is the reason it is called a unified credit. Under EGTRRA, lifetime gifts in excess of $1,000,000 are taxed. This was the case even during the year 2010 when the estate tax was repealed.

Thus, an individual who died during 2010 passed his or her assets to his or her heirs without tax, but he or she could not have given more than $1,000,000 of his or her assets away while alive in 2010 without being taxed. Why did Congress enact such an absurd law? The answer was in the budget. Congress needed to constrain the "cost" of estate tax repeal and other tax reductions to fit within its self-imposed $1.35 trillion dollar cap. Since a temporary repeal costs less than a permanent one, EGTRRA was enacted with a "sunset" provision that was to take effect in 2011. The thought at the time was that some future Congress will eventually make the estate tax repeal permanent. That almost happened. On April 13, 2005, the House of Representatives voted 272-162 to finish off the estate tax by making the estate tax repeal permanent after 2010. The Republican-controlled Senate came within three votes of a complete repeal.

With Democrats controlling the House and Senate following the 2006 election, a subsequent vote on the permanent repeal of the estate tax never occurred. What did occur on December 19, 2010, a mere 12 days before EGTRRA was to expire, was the enactment of TRUIRJCA. TRUIRJCA was part of a compromise between Democrats who wanted increased stimulus spending to spark the economic recovery, and Republicans who wanted tax cuts (never mind that big spending + big tax cuts = big deficits). In simple terms, TRUIRJCA extended EGTRRA two additional years, increased the unified credit amount for estates and gifts to $5,000,000 and reduced the top rate to 35 percent. It also allows unified credit portability among married individuals so that if the poor spouse dies first, the surviving rich spouse can use all of the deceased spouse's unused unified credit. Although there was no estate tax in 2010, many heirs were outraged that they may have to pay capital gain tax on part of their inheritance sometime in the future. So, TRUIRJCA, the tax act with a big heart, gave those heirs the option of no estate tax or the retroactive application of TRUIRJCA (allowing full step up, a $5,000,000 unified credit amount and a 35% rate).

The absurdity continues. The uncertainty resulting from the passage of tax provisions with an expiration date causes taxpayers difficulty in planning. There are real victims of such uncertainty. During 2010 (before TRUIRJCA was enacted) some taxpayers opted to make large gifts in 2010 and pay the gift tax at a 35 percent rate in lieu of paying a higher 55 percent estate tax rate after 2010. After TRUIRJCA, some of those taxpayers may not owe any estate tax and may have paid gift tax unnecessarily. Further, future legislation may have retroactive effect. Consider the Baucus bill that would have implemented a 45 percent gift tax rate effective for gifts after December 2, 2010. The value of Iowa farmland has sharply increased the past few years as a result of higher commodity prices. This author knows of recent farmland sales over $10,000 an acre. A farmer owning a 1,000 acre farm may own an asset worth $10,000,000 and have a potential estate tax problem. With 2013 looming, estate tax planning needs to be started now.

For any questions regarding estate planning please contact David Repp.

The material in this blog is not intended, nor should it be construed or relied upon, as legal advice. Please consult with an attorney if specific legal information is needed.

- David Repp

Categories: Trusts & Estates Law, Taxation Law, David Repp, Real Estate & Land Use

Questions, Contact us today.

The material, whether written or oral (including videos) that is posted on the various blogs of Dickinson Bradshaw is not intended, nor should it be construed or relied upon, as legal advice. The opinions expressed in the various blog posting are those of the individual author, they may not reflect the opinions of the firm. Your use of the Dickinson Bradshaw blog postings does NOT create an attorney-client relationship between you and Dickinson, Bradshaw, Fowler & Hagen, P.C. or any of its attorneys. If specific legal information is needed, please retain and consult with an attorney of your own selection.